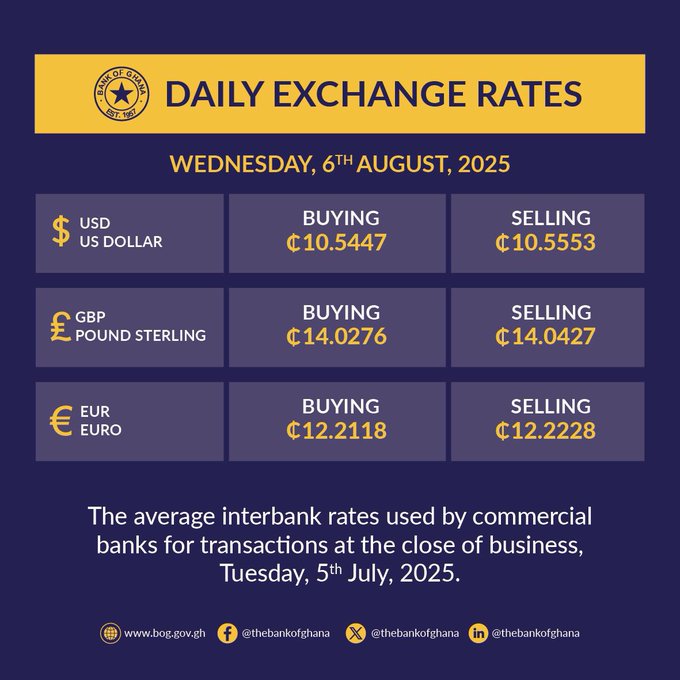

The Ghanaian cedi is showing signs of renewed depreciation, according to the latest daily exchange rates published by the Bank of Ghana on Wednesday, 6 August 2025. The central bank’s figures, which reflect interbank averages from commercial banks’ transactions on 5 July 2025, indicate that the cedi’s value against major currencies has weakened slightly, sparking concern among economists and social media users alike.

The new rates list the US dollar’s buying and selling prices at ¢10.5447 and ¢10.5553 respectively, the British pound at ¢14.0276 to ¢14.0427, and the euro at ¢12.2118 to ¢12.2228. This follows a period of volatility for the cedi, which has been a topic of heated discussion on platform X, where users have noted a gradual upward trend in foreign currency rates. One commenter, @SupaMarioo, remarked, “Gradually it has started depreciating… hmmm,” while @CediRates confirmed slight rises across the dollar, pound, and euro.

The data, sourced from the Bank of Ghana’s official X post (@thebankofghana, 08:31 GMT, 6 August 2025), highlights a lag of over a month in the interbank averages, raising questions about the real-time accuracy of these figures amid Ghana’s ongoing economic challenges. The African Development Bank’s latest outlook, updated on 31 July 2024, forecasts inflation to remain high at 20.9% in 2024, easing to 11.1% in 2025, driven by global economic pressures and limited access to foreign exchange. This context suggests the cedi’s depreciation could exacerbate inflationary pressures, particularly for essential imports like food and fuel.

Historically, the cedi has faced significant declines, with a reported 55% drop against the US dollar between January and October 2022, according to trade.gov. The Bank of Ghana has implemented measures such as ending forex support for certain imports in November 2022 to stabilise the currency, but the latest figures indicate these efforts have yet to fully reverse the downward trend. Social media reactions have ranged from frustration—“The thing dey rise everyday,” posted by @agbeko_—to wry humour, with @m_carthy191 likening the cedi’s movement to “simple harmonic motion.

” Economists warn that without decisive policy interventions, the cedi’s volatility could continue to impact Ghana’s economy, affecting sectors such as agribusiness, pharmaceuticals, and consumer goods. The Bank of Ghana has been contacted for comment on its strategy to address the current depreciation, but no immediate response was available at the time of publication.

This article reflects the latest available data and analysis as of 06 August 2025, 08:59 GMT.

Bigstuffmediagh.com will continue to monitor developments and provide updates as they emerge.*