The Governor of the Bank of Ghana (BoG), Dr Johnson Asiama, has revealed that the central bank will soon introduce guidelines for digital lending in the country.

According to him, the move is aimed at protecting consumers while fostering stronger partnerships between fintechs and banks.

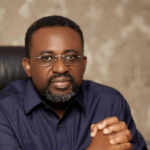

Dr Asiama made this known when he addressed members of the Ghana Association of Banks at their 42nd Annual General Meeting on October 23, 2025, which also coincided with the launch of the Ghana Bankers Voice Magazine.

He noted that the Bank of Ghana’s Open Banking Framework, currently in its proof-of-concept phase, “will enable secure data sharing between banks and fintechs under clear standards for consent, privacy, and cybersecurity.”

Dr Asiama further disclosed that the Bank of Ghana is collaborating with the Securities and Exchange Commission (SEC) and the Financial Intelligence Centre (FIC), among others, to develop formal cryptocurrency regulations by December 2025.

“I am pleased to say we have finalized the bill ready for submission to Cabinet. This progress places Ghana among the first African jurisdictions to regulate digital-asset activity prudently,” he stated.

Deepening Financial Intermediation

The Governor also announced that the Bank of Ghana is working with Development Bank Ghana, the World Bank, and Afreximbank to expand access to credit and trade finance through risk-sharing facilities.

“We are aligning Ghana’s banking infrastructure with continental systems like the Pan-African Payment and Settlement System (PAPSS), which enables cross-border payments in local currencies,” he said.

He added that the Bank, with support from the International Monetary Fund (IMF), has launched a structured foreign exchange operations framework to improve price discovery, reduce volatility, and rebuild reserves.

Dr. Asiama also revealed that the central bank is developing a comprehensive Digitalisation Strategy to guide how it uses technology and data to serve the financial system more effectively.

“We are sending our teams out to the best central banks — from Singapore to London to the Philippines — to learn, experiment, and benchmark against the best, bringing global lessons home,” he disclosed.

He added that a dedicated Bank of Ghana team will soon engage with the Ghana Association of Bankers and individual banks to ensure their perspectives help shape the digitalisation strategy from inception.

AI-Driven Supervision

Dr Asiama emphasised that the central bank is committed to enhancing oversight in the banking sector through technology and innovation.

He revealed that the Bank of Ghana is investing in AI-driven supervisory tools and operationalising a Cyber Threat Intelligence Platform to facilitate information sharing between banks and fintechs.

“As banks migrate more systems to the cloud, operational resilience and third-party risk management will become as critical as capital adequacy.

“Cyber maturity is now a measure of institutional soundness, and our supervisory priorities will increasingly reflect that,” he explained.

The Governor further disclosed that the Bank is piloting an ESG and Climate-Risk Reporting Template to embed sustainability into credit and investment decisions.

“Innovation without trust will not endure, but prudence must never again be an excuse against innovation,” he stressed.

He concluded by urging commercial banks to recognise the changing nature of Ghana’s customer base.

“More than 60 percent of Ghanaians are under 35. For them, banking is not a destination — it is an experience that follows them everywhere,” Dr. Asiama stated.