Metropolitan Insurance has officially rebranded to emPLE Life, marking a major strategic shift to expand insurance accessibility and accelerate digital innovation across Ghana’s insurance landscape. The announcement was made at a news conference held at the Marriott Hotel in the Greater Accra region.

The rebrand marks the transition of Metropolitan Insurance, long known for its presence in pensions, life, and health insurance, into a modern, technology-led institution designed to meet the needs of both the formal and informal sectors.

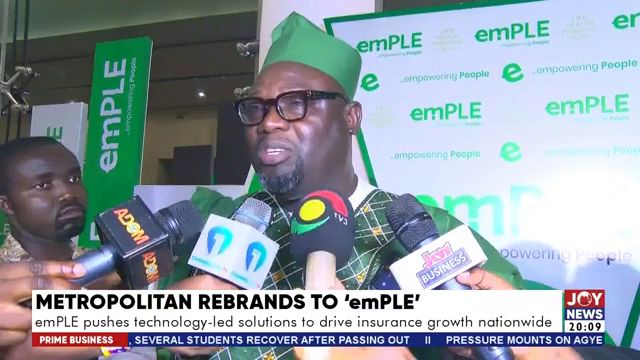

Dr. Rafique Daudi, CEO and Country Head of emPLE, emphasized that the company’s renewed focus is built on simplifying insurance processes and strengthening customer accessibility. He highlighted the critical role of technology in bridging Ghana’s significant informal sector gap.

“Everything about our company, our business, our products and services is being optimized through technology. We offer 24-hour service so customers can always reach us when needed. Nearly 80 percent of the workforce is in the informal sector. Technology is going to play a mediating role, just as the mobile money ecosystem has done. We’ve already rolled out technology-driven products that are expanding insurance uptake and creating value,” he said.

Dr. Daudi also addressed public skepticism around insurance, noting that emPLE’s simplified processes have enabled same-day claims payments, with plans to reduce this to a matter of hours.

President of the Insurance Brokers Association of Ghana, Shaibu Ali, described the rebranding as a development that will stimulate activity within the sector.

“The entry of this new brand, taking over Metropolitan Life, will engineer a lot of new energy and innovation. A takeover introduces fresh drive, and we expect emPLE’s technology capabilities to help deepen insurance penetration. We look forward to what they bring on board and how brokers can leverage it to serve clients better,” he said.

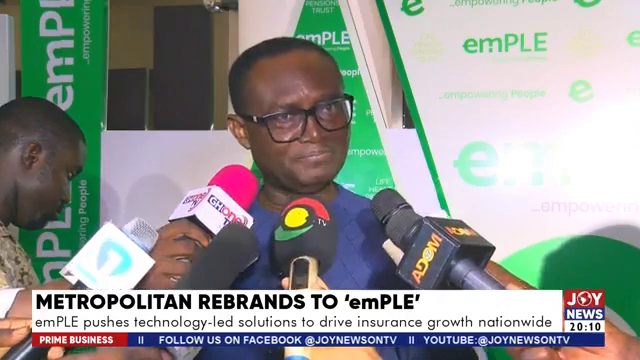

Board Chairman of emPLE Life, Kwame-Gazo Agbenyadzie, highlighted the company’s legacy and outlined its plans for expansion under the new ownership.

“Metropolitan has operated for almost two decades, offering pensions, life, and health insurance. With the transition to emPLE, we are maintaining these products but leveraging emPLE’s technology partnerships to digitalize offerings. Our goal is to reach the informal sector more effectively. We are already piloting a product called Medscare targeting this segment,” he said.

Mr. Agbenyadzie added that emPLE will introduce additional health insurance products, expand pension solutions, and enhance customer service delivery. With access to the wider Ample Group international network, the company plans to bring proven solutions from markets like Nigeria into Ghana.

The rebranding to emPLE Life marks a renewed commitment to accessibility, innovation, and customer-centric service within Ghana’s insurance ecosystem. With strong leadership, technology-forward strategies, and an expanded product lineup, the company positions itself to play a defining role in increasing insurance penetration, particularly within underserved informal communities. The industry now looks to see how emPLE will shape the next phase of Ghana’s insurance evolution.