The Attorney-General and Minister of Justice, Dr Dominic Ayine, has announced that the government will prosecute Wontumi Farms and its directors for allegedly defrauding Exim Bank, committing forgery, and causing a financial loss to the state exceeding GH₵24 million.

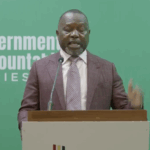

Dr Ayine made this known during the Government’s Accountability Series on Monday, January 22.

He also gave updates on some Operation Recover All Loots (ORAL) investigations and prosecutions during the series.

Read also: Wontumi Farms, directors to face prosecution over GH₵24m alleged EXIM Bank loan fraud

Below is the full investigation by the Minister;

OFFICE OF THE ATTORNEY-GENERAL

ACCRA

December 22, 2025.

PRESS BRIEFING BY THE ATTORNEY GENERAL: INVESTIGATIONS INTO THE ACTIVITIES OF WONTUMI FARMS AND AN UPDATE ON CERTAIN ASPECTS OF THE ORAL INVESTIGATIONS AND PROSECUTIONS

Ladies and Gentlemen of the Media

My Fellow countrymen and women

- Today’s press briefing announces the conclusion of two sets of investigations by the Economic and Organized Crime Office (EOCO). The first part will announce the conclusion of investigations into the activities of Wontumi Farms Limited, a corporate entity established by Bernard Antwi Bosiako, also known as Chairman Wontumi. Second part will announce the conclusion of investigations into the fraudulent activities of Mr. Percival Kofi Akpaloo, the founder and leader of the Liberal Party of Ghana (LPG). Finally, I will provide a brief update on aspects of the ORAL investigations and prosecutions.

- You would recall that in March this year, the Economic and Organized Crime Office arrested Chairman Wontumi on reasonable suspicion of the commission of a crime. Chairman Wontumi is the sole shareholder, director and chief executive officer of Wontumi Farms Limited. The arrest was pursuant to credible intelligence gathered by the EOCO that the company and its director and CEO were involved in a fraudulent transaction in connection with a purported loan facility granted by the Ghana Exim Bank under the Mining Alternative Livelihoods Initiative of the Bank.

- The Alternative Livlihoods Initiative was designed by Exim Bank to provide alternative sources of livelihoods for the youth in areas of the country affected by the phenomenon of illegal mining. In doing so, the Bank intended that the loans under the program would go to companies committed to the ensuring the realization of the objectives of the initiative, especially in relation to job creation for young persons in mining communities.

- In December 2017, Wontumi Farms Limited submitted its application for a loan of Ghs18 Million purportedly to cultivate maize on 100,000 acres of farmland and to employ the youth on the farm. At the time that the application was submitted by Wontumi Farms Limited together with a purported board resolution, the company was not registered. In short, the company did not exist at the time of the loan application by its sole shareholder and director.

- Investigations established that Wontumi Farms Limited was incorporated on December 14, 2017, and issued a certificate to commence business on same day. The principal business activities of the company, as stated in its corporate registration documents, are general farming, agribusiness and agro-processing. The directors of the company are Bernard Antwi Boasiako and Thomas Antwi Boasiako with Bernard Antwi Boasiako being 100% shareholder of the company and also listed as company secretary. Thomas Antwi Boasiako is believed to be the brother of Bernard Antwi Boasiako domiciled in the USA.

- Prior to the registration of Wontumi Farms Limited, Chairman Wontumi wrote to Exim Bank that the board of directors of Wontumi Farms had met on December 9, 2017, and had resolved to seek a loan facility of Ghs19 Million from the Bank to support its farm project at Asare Nkwanta in the Ashanti Region under the Mining Alternative Livelihood Initiative. The application letter stated among other things that the credit facility was meant for a farming venture and that the company had secured 100,000 acres of land for that purpose.

- On January 16, 2018, based on the application submitted by Bernard Antwi Boasiako, chief promoter of Wontumi Farms, Exim Bank approved a medium term-loan facility of Ghs18,734,260.00 which included a grant component of Ghs6,768,260.00. This offer was accepted via a letter dated January 23, 2018, and Chairman Wontumi, acting as the Chief Executive Officer of Wontumi Farms Limited and Thomas Antwi Boasiako, as director of Wontumi Farms Limited.

- The offer letter indicated that the approval of the medium-term loan facility was subject to the Bank’s terms and conditions. The loan offer letter further stated that the loan was secured with 10,000 acres of the farmland of Wontumi Farms Limited at Asare Nkwanta.

- The breakdown of the approved Ghs18,734,260.00 loan as per the offer letter is as follows:

- Purchase of agricultural plant and machinery – GH₵3,865,000.00

- Working capital – GH₵8,101,000.00

- Grant -staff cost and consultancy fees – GH₵6,768,260.00.

- As part of the pre- disbursement conditions of the loan, Wontumi Farms Limited was to do the following amongst others:

- Execute an equitable mortgage over the land earmarked for the project;

- Submit a valuation report on the land to be used as collateral

- Execute a lease agreement over the equipment

- Provide a letter of undertaking from off takers to make payments in the joint names of Ghana Exim Bank and Wontumi Farms Limited.

- Submit copies of the contract with the National Buffer Stock Company (NAFCO), under which Wontumi Farms was to supply food items to NAFCO

- IESO Agribusiness Consult, a company specialized in investment advisory, consultancy, training and development was contracted by Exim Bank and assigned to Wontumi Farms Limited as the consultant to the project. The key function of IESO Agribusiness Consult was to provide Technical Assistance to Wontumi Farms Limited.

- On February 14, 2018, Eban Capital Limited, a company that specializes in financial technology services, cash management services, distribution of custom banking and payment software packages was contracted by Exim Bank and assigned to Wontumi Farms to provide a platform that will facilitate staff salary payments, customization, integration, POS terminals and biometric cards for the farmhands that were to be employed by Wontumi Farms.

- Wontumi Farms Limited was to provide Eban Capital Limited with the database of all workers, from which Eban Capital limited was to integrate the workers on a payment platform. Eban Capital Limited would then receive funds directly from Exim Bank for onward disbursement to workers wallets as salaries and allowances.

- Wontumi Farms Limited failed to provide the database of farmers to Eban Capital as there were no farmers working on the land. According to witnesses, Bernard Antwi Boasiako, CEO of Wontumi Farms Ltd, insisted and pressured Eban Capital and EXIM Bank to transfer the Ghs 400,000.00 meant for the workers to Wontumi Farms Limited on the basis that the youth who were involved in galamsey were not used to complex electronic payment systems and wanted to be paid in cash.

- In order to execute the project, Wontumi Farms Limited had submitted a proforma invoice to Exim Bank for the purchase of farm equipment, including tractors, combined harvesters, corn seeder machines and wellington boots. The invoice was submitted on December 15, 2017, as part of the loan application process. Subsequently, Exim Bank demanded proof that the equipment has been purchased. On March 18, 2018, Chairman Wontumi submitted a receipt from Kas-Sama Enterprise for the purchase of the equipment in the sum of Ghs4 Million.

- However, and this is where it gets interesting, the equipment purchased as shown on the said receipt included a bulldozer and an excavator.

- Our investigations established that Chairman Wontumi had approached Kas-Sama Enterprise, an industrial equipment dealer and obtained an invoice with a promise to return to purchase the said equipment. He never went back to purchase the equipment. Instead he forged the invoice he obtained from Kas-Sama Enterprise by removing the word “invoice” and replacing it with “receipt”. This forged receipt was then submitted to Exim Bank by as proof that he had purchased the said equipment after the disbursement.

- The owner of Kas-Sama Enterprise confirmed to investigators that the only document he issued to Wontumi Farms through Chairman Wontumi was an invoice and not a receipt. He stated that after he issued the invoice, he never heard from Chairman Wontumi again despite repeated follow-upcalls. The forged receipt submitted to Exim Bank suggested that Kas-Sama Enterprise acknowledged receipt of Four Million Ghana Cedis for the purchase of earth moving machines and farming equipment. The so-called receipt had on it “50 days to supply and 1 year guarantee and service”, meaning that it was a proform invoice and not a receipt of payment.

Ladies and Gentlemen of the Media

- Investigations established that Bernard Antwi Boasiako did not purchase any equipment and as such could not register any equipment in the joint names of Eximbank and Wontumi Farms Limited as per the loan conditions even though funds were disbursed to him to that effect. That, all equipment the Mr. Bosiako claimed he purchased could not be traced.

- Investigations established that though Bernard Antwi Boasiako submitted the forged receipt to Exim Bank, he stated during interrogation that he purchased “secondhand brand new” equipment and that the receipts of all the purchases including the documents on the equipment were all sent to the Bank. Exim Bank denies that neither Wontumi Farms nor Chairman Wontumi submitted any documents covering the purchase of the required equipment except the forged receipts.

Ladies and Gentlemen of the Media

- It is clear from our investigations that Chairman Wontumi and his company, Wontumi Farms Limited, made fraudulent misrepresentations to Exim Bank with a view to obtaining the loan facility and in fact did obtain the loan facility. The equipment they represented were to be purchased were never procured. The farming enterprise never materialized, and so no young persons were employed in Asare Nkwatia. But more importantly, the company and its director and CEO forged a receipt in order to deceive Exim Bank that they were in compliance with the loan conditions. These are not mere breaches of a loan contract but constitute acts of criminality by no mean a person than the regional chairman of the then ruling Party.

- In the circumstances, and in the face of the evidence we have gathered in this investigation thoroughly conducted by the Economic and Organized Crimes Office, we have made the decision to prosecute Wontumi Farms and its directors with defrauding by false pretences, forgery and causing financial loss to the state in sum of Ghs24,255,735. This figure represents the principal sum plus the interest that has accrued.

Ladies and Gentlemen of the Media

- In the case involving Mr. Percival Kofi Akpaloo of the Liberal Party of Ghana, Financial Intelligence Centre (FIC) flagged and filed a suspicious transaction report with First Bank Ghana regarding transactions on an account belonging to Pomaah Universal (Gh.) Ltd.

- Following the STR by the FIC, the EOCO begun an investigation into the matter. The investigations revealed that Pomaa Universal (Gh.) Ltd, a business entity owned entirely by Akua Pomaa, was the legitimate contractor that was awarded a COCOBOD feeder road contract. The contract, valued at over Ghs29.5 million, was awarded in December 2020. Although the project commenced and an initial payment was properly deposited into Pomaa Universal Limited account, subsequent payments raised serious concerns regarding misrepresentation, forgery, and unauthorized handling of cheques.

- Our investigations revealed that Akpaloo secretly incorporated a separate company, Pomaah Universal (Gh.) Ltd, deliberately designed to closely resemble Pomaa Universal (Gh.) Ltd, differing only by the addition of an “h.” Between December 2022 and June 2024, Akpaloo collected eight cheques issued by COCOBOD in the name of Pomaa Universal (Gh.) Ltd, totaling Ghs3,169,432.22, and deposited them into the account of his own company at First Bank Ghana.

- Again, investigations confirmed that Akua Pomaa was unaware of both of the existence of Pomaah Universal (Gh.) Ltd and the diversion of funds until COCOBOD contacted her in June 2024 regarding outstanding balances on the contract. She subsequently discovered that Akpaloo had collected and misdirected the payments without her consent. Akua Pomaa also alleged that Akpaloo forged her signature on the COCOBOD contract using her former name, Mercy Owusu, to secure the agreement without her authorization.

- First Bank Ghana’s internal investigations corroborated the fraud allegations, concluding that Akpaloo knowingly misrepresented ownership of the cheques and deposited them into the wrong account. The bank acknowledged operational failures in detecting discrepancies between the cheque payee names and the account numbers.

- The suspects who have been investigated are Percival Kofi Akpaloo, Pomaah Universal (Gh.) Ltd, and Delvine Akpaloo, the spouse of Percival Kofi Akpaloo. The evidence shows that they engaged in various criminal offences including stealing, forgery and money laundering and will be charged by my office in January.

Ladies and Gentlemen of the Media

My Fellow countrymen and women

- Further to the update that I provided during my press conference to announce the conclusion of investigations into the Buffer Stock scandal, my Office continues to work with other institutions of state to bring charges in relation to the ORAL investigative reports submitted by the National Intelligence Bureau (NIB). As you would have known by now, pursuant to discussions with the Auditor General, the sums of money involved in the National Service scandal have been disallowed by the Auditor General and has been surcharged on the public officers who superintended the looting of state resources at the NSA. The notices of disallowance and surcharge have been duly issued and served on the said public officers.

- After 14 days, if they fail to show cause why the sums of money should not be disallowed and surcharged on them, the money becomes a debt due and owing to the state and I will proceed to take civil action to recover the sums involved. Once judgment is obtained, it will be executed using the civil procedure mechanisms including the attachment of properties they own, whether or not these properties were part of the proceeds of crime. I intend to write formally to the Auditor General for confirmation of the notices of disallowance and surcharge.

- Overall, the ORAL investigations are proceeding well, and we continue to beef up initial investigative reports in order to file charges that meet the standard of proof in criminal trials.

Thank you all for your attention. I will now proceed to take questions.