Atwima Kwanwoma Rural Bank PLC has announced a 100% increase in its share price, raising it from fifty pesewas to one cedi.

The current price will be maintained for existing shareholders over the next eight months.

According to the Bank, the increase reflects the value it has created over the years. Despite the 100% hike, management believes the intrinsic value of the shares exceeds the new pricing.

Chief Executive Officer, Samuel Bonsu Sekyere, emphasised that the new pricing was determined with their target market in mind.

“Given the industry in which we operate, we had to consider the general environment before adjusting the price. If not for the nature of our industry, the value would have been far higher than what we are proposing now,” he stated.

With this increase, the Bank expects improved liquidity from share sales, which will positively impact operations.

The Bank of Ghana has set a minimum capital requirement of one million cedis for rural banks. With this increase, Atwima Kwanwoma Rural Bank is in a stronger position to meet any future capital requirements.

“The Bank has met the indicators set by the Bank of Ghana, and we have indications that in the near future the Bank of Ghana will raise the minimum capital requirement for rural banks,” Mr. Sekyere added.

Profit and Dividends

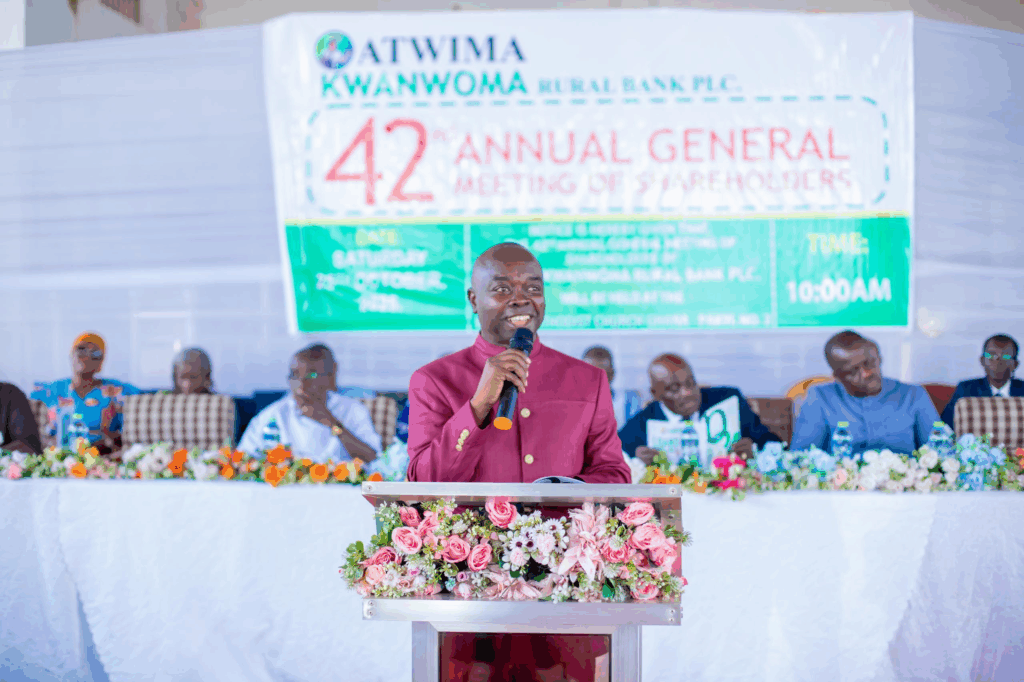

At the 42nd Annual General Meeting, the Bank reported a profit before tax of 54.4 million cedis in 2024, up from 24.7 million cedis in 2023 representing a growth of 120.32%.

Consequently, profit after tax rose from 17.1 million cedis in 2023 to 37.6 million cedis in the year under review.

As a result, the Bank of Ghana has approved the payment of dividends for the year. The Board has proposed a 40% return on investment, representing 0.20 cedis per share.

“In total, 18,429,175 ordinary shares qualify for the dividend as of the register closure on September 24, 2024, amounting to GHS 3,685,835.00,” announced Board Chairman Mr. Kwame Kyei Kusi.

By the end of the 2024 financial year, the Bank’s total deposits stood at 592.1 million cedis, up from 378 million cedis the previous year, an increase of 56.64%.

The investment portfolio also grew to 500 million cedis in 2024, representing a 67.93% increase.

Loans granted to clients rose to 102 million cedis from 76 million cedis, marking a 33.43% increase.

Atwima Kwanwoma Rural Bank has exceeded the Bank of Ghana’s one million cedis stated capital requirement by over 300%.

By the end of 2024, the Bank’s stated capital had increased to GH¢ 4,973,549, up from GH¢3,929,712 the previous year.

Corporate Social Responsibility and Future Outlook

Following the increase in profit margins, the Bank expanded its investment in its catchment area. A total of 212,000 cedis was invested in health, education, security, agriculture, and other social needs contributing to development in the local communities.

To enhance service delivery, the Bank has initiated the construction of a modern office for its Old Tafo Branch.

“The property, a plot of land, was acquired last year as part of the Bank’s strategic plan to build and relocate the Old Tafo Branch to a more spacious facility. The current premises can no longer accommodate our growing customer base, leading to congestion and discomfort for both customers and staff,” Mr. Kyei Kusi explained.

“We are also exploring another location within Kumasi or Greater Kumasi, preferably Suame, to open a new branch and bring our services closer to the people in that community,” he added.