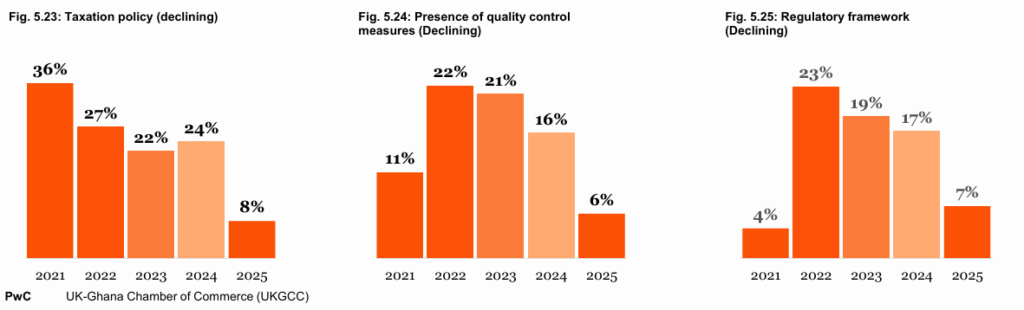

Businesses have expressed a more favourable view of Ghana’s taxation landscape, largely due to the government’s efforts to ease the tax burden and simplify compliance by removing taxes such as the Electronic Transaction Levy (E-Levy) and Covid 19 Levy.

According to the 2025 United Kingdom Chamber of Commerce (UKGCC) Business Environment and Competitiveness Survey, business leaders found out that firms are increasingly adopting standardised processes and certifications to ensure products and services meet required standards.

Respondents also noted a strong regulatory environment which helps businesses plan and invest with confidence.

The perceptions about taxation policy saw some improvement in 2025, as it improved by 16% compared to prior years.

Presence of Quality Control Measures

The survey also identified that businesses’ perceptions about quality control progressively improved in the last three years.

This year, businesses show great satisfaction with the measures that have been put in place.

“The importance of quality control cannot be overemphasised for business, especially in manufacturing and agriculture. The Food and Drugs Authority (FDA) has reinforced inspection protocols and certification systems, ensuring Ghanaian products remain competitive in global markets”.

Since 2022, perceptions have progresssively improved, but most significantly this year.

Businesses expressed satisfaction with the regulatory environment. They generally find the regulatory landscape to be much less restrictive and/or costly to navigate or achieve compliance.