FirstBank Ghana has concluded the third edition of its Junior Internship Programme (JIP) with a closing ceremony and prize presentation event held in Accra on Tuesday.

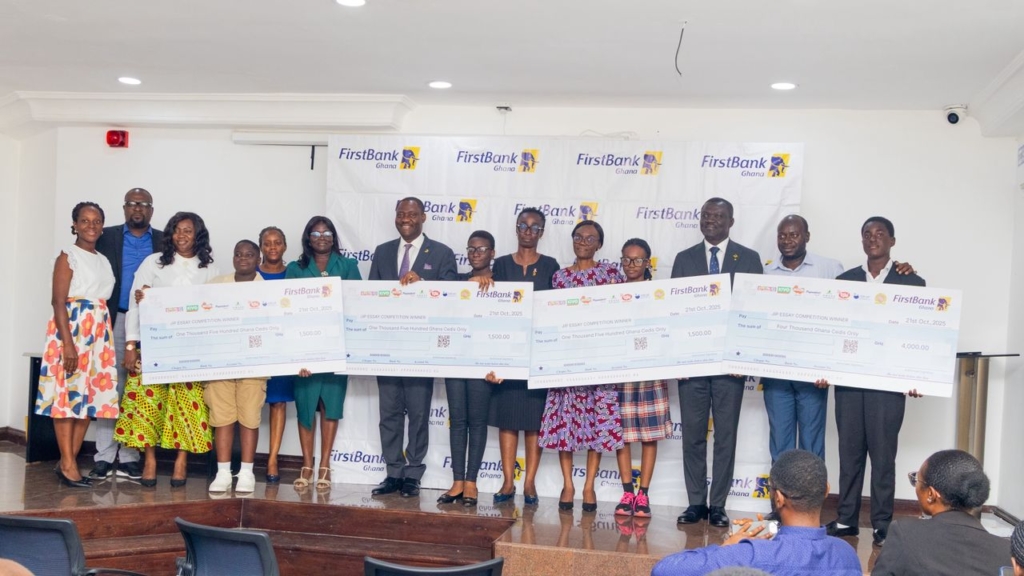

The occasion also recognised winners of an essay writing competition introduced as part of this year’s programme.

Speaking at the ceremony on Tuesday October 21, the Managing Director of FirstBank Ghana, Mr. Victor Yaw Asante, reaffirmed the bank’s commitment to empowering young people through education and exposure, describing the initiative as a strategic investment in Ghana’s future.

“When we launched the Junior Internship Programme three years ago, our dream was simple — to open doors early and spark confidence, purpose, and curiosity in the next generation,” he said. “Our aim has never been to teach banking, but to shape mindsets and nurture qualities such as confidence, communication, discipline, teamwork, curiosity, and respect for time.”

Mr. Asante emphasised that the initiative embodies the bank’s “You First” philosophy, which prioritises people above all else. “There is no better expression of ‘You First’ than investing in the education, exposure, and empowerment of young people. Education remains one of our highest social investment priorities because it is the surest path to transforming families, communities, and the future of our nation,” he noted.

He further highlighted Ghana’s youthful population, observing that about 57 percent of citizens are under the age of 25, with the 11 to 14 age group — the target of the JIP — estimated to number over 4 million. Mr. Asante said the bank views this demographic reality as both an opportunity and a responsibility.

“In the next decade, these young people will become the backbone of Ghana’s workforce and the drivers of innovation across all sectors. The values and ambitions they cultivate today will shape the destiny of our nation tomorrow,” he stated. “That is why this initiative is more than an internship — it is a deliberate, long-term investment in building Ghana’s human capital.”

As part of this year’s programme, an essay writing competition was introduced to encourage creativity and critical thinking among participants. Out of 680 interns, 364 took part in the competition, with eight outstanding winners emerging. The overall winner, who scored 29.5 points, received a cash prize of GHS4,000, while seven other finalists, each scoring 29 points, received GHS1,500 each.

Mr. Asante expressed appreciation to partners and sponsors, including Junior Graphic, KIVO, Gino Jollof, Pepsodent, Awake Purified Water, Kiki Juice Drink, Top-Up Pharmacy, and Indomie Ghana, for their invaluable support. “You are not just sponsors; you are collaborators in building something truly transformational,” he remarked.

In his closing address, the Managing Director commended the interns, parents, volunteers, and staff for their dedication to making the programme a success. “We are not just shaping students; we are shaping citizens, innovators, and future leaders of Ghana,” he said. “To our winners, congratulations once again. To our interns — the future is yours. Go and shine. Go and make a difference.”

He announced that preparations were already underway for the 2026 edition of the Junior Internship Programme, promising it would be “even bigger, bolder, and better.”

With that, Mr. Asante officially declared the 2025 Junior Internship Programme closed, marking another milestone in FirstBank Ghana’s ongoing efforts to nurture the next generation of Ghanaian leaders.

On his part, the Head of Retail Banking at the Bank, Mr. Allen Quaye, said the initiative also forms part of the Bank’s Corporate Social Responsibility efforts in the area of education.

“Leveraging our Corporate Social Responsibility, particularly in education, we looked at our child customers and asked ourselves what we could do for them. We also realised that there is a gap in providing meaningful career guidance to students at a very young age. Therefore, recognising this need, we decided to introduce the Junior Internship Programme to help children learn about banking and gain exposure to other sectors of the economy,” he said.