Ghana’s Finance Minister, Dr Cassiel Ato Forson, has announced a significant milestone in the country’s economic recovery, revealing that the government has disbursed GH¢9.7 billion in coupon payments under the Domestic Debt Exchange Programme (DDEP) on Tuesday, 19 August 2025. This payment, detailed in a statement from the Ministry of Finance, brings the total disbursements for the year to GH¢19.4 billion, underscoring the government’s unwavering commitment to honouring its debt obligations.

Speaking from a parliamentary session, Dr Forson highlighted the payment as a testament to the government’s dedication to restoring fiscal credibility. “This disbursement demonstrates our unwavering commitment to honouring the terms outlined in the Memorandum of Understanding signed under the exchange programme,” he said, addressing a packed chamber. The move is expected to bolster investor confidence amid ongoing efforts to stabilise the economy.

The DDEP, launched in 2022 as part of a broader economic reform agenda, aimed to restructure Ghana’s domestic debt following a challenging period marked by global economic shocks, including the aftermath of the COVID-19 pandemic and the war in Ukraine. Despite initial creditor participation of only 50-70%—lower than Argentina’s 75% in its 2000 debt exchange, according to The Africa Report—the programme has gained traction, supported by international partners such as the International Monetary Fund (IMF) and the World Bank.

To further safeguard future obligations, the government has established two dedicated sinking fund accounts—a Cedi Sinking Fund Account and a US Dollar Sinking Fund Account—as mandated by the Public Financial Management Act, 2016 (Act 921). These funds are designed to provide liquidity buffers for the timely redemption of bonds maturing in 2026, 2027, and 2028, a strategy welcomed by economic analysts.

Dr Forson assured the public and investors that subsequent debt obligations would be met fully and on time. “This payment, alongside the new sinking funds, is a critical step towards ensuring macroeconomic stability and protecting the most vulnerable,” he added.

The announcement comes against the backdrop of Ghana’s recent economic challenges, including a period of central bank cash printing—equivalent to nearly half of domestic revenue—to service debt, which fuelled inflation and necessitated an IMF bailout. This pragmatic shift from the government’s earlier anti-IMF stance has been supported by a robust $4.69 billion World Bank portfolio aimed at mitigating global trade risks and fostering resilient growth.

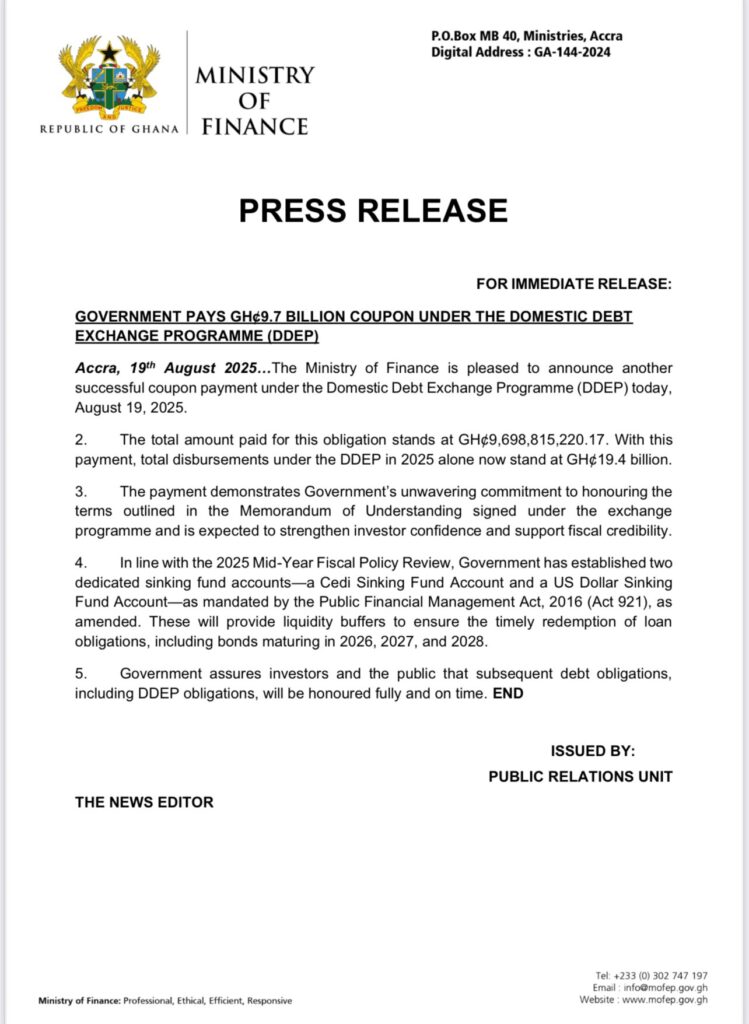

Find attached a press release that was posted on the Ministry of Finance X account:

As the country navigates these reforms, all eyes will be on the government to deliver on its promises, with the DDEP payments serving as a litmus test for its fiscal strategy.