![]()

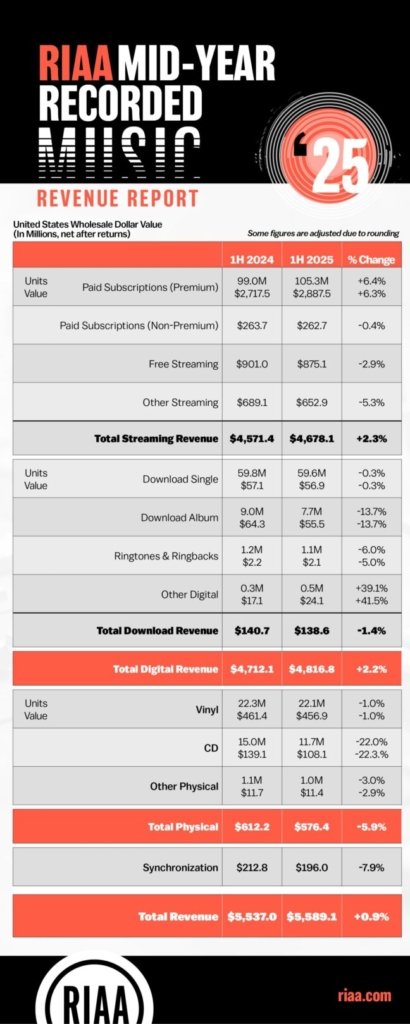

The United States’ recorded music industry saw revenue growth of just 0.9% YoY in the first half of 2025.

That’s according to the new data published by the RIAA today (September 9), which shows the United States generated USD $5.59 billion in wholesale recorded music revenue in the six months to end of June.

(Unlike previous years, the RIAA has shifted to reporting industry revenues on a wholesale, rather than retail, basis.

This represents actual revenue flowing to music companies rather than total consumer (retail) spending, but makes comparisons with earlier years more complicated.)

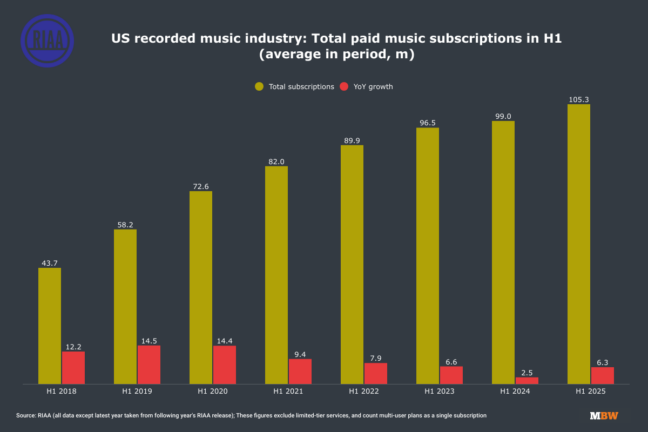

One positive stat: There were 105.3 million total paid premium music subscriptions in the period, up 6.3 million YoY.

That +6.3 million YoY net growth was significantly higher than the equivalent growth seen in H1 2024 (+2.5m, see below).

Premium paid subscription revenues grew 6.3% YoY in the US in H1 2025 to $2.89 billion.

However, this subscription growth bright spot was offset by declines across other streaming revenue fields:

- ‘Free streaming revenue – which includes ad-supported audio and music video services not operating under statutory licenses, as well as social media and fitness apps – fell 2.9% YoY to $875.1 million;

- ‘Non-premium‘ paid subscriptions – covering “subscriptions with limited catalogs or device restrictions” – saw revenue decline 0.4% YoY to $262.7 million;

- “Other streaming” revenue, a category combining payments for digital and customized radio services under statutory licenses, including SoundExchange distributions, dropped 5.3% YoY to $652.9 million.

As a result of these declines, Total streaming revenue reached $4.68 billion, up 2.3% YoY.

There was also a reversal in physical format sales, which had provided a crucial growth engine in recent years.

Total physical revenue declined 5.9% to $576.4 million in the United States in the first half of 2025. Within this figure:

- Vinyl sales, which have been a rare bright spot for the industry over the past decade, fell 1% YoY in both units (22.1m sold in H1 2025 versus 22.3m in H1 last year), and in dollar value terms, to $456.9 million.

- CD sales continued their decline, dropping 22% YoY in both units (to 11.7m, from 15m in H1 2024) and revenue (to $108.1 million).

Despite the decline, vinyl continued to dominate physical formats, accounting for more than three-quarters of physical revenue and outselling CDs for the fifth consecutive year.

Elsewhere, synchronization licensing – typically a high-value revenue source for labels – declined 7.9% to $196 million.

The RIAA‘s H1 report also emphasized the US music industry’s continued global dominance, noting that one in three streams globally feature American artists.

American music exports now exceed those of the next six biggest exporting countries combined, according to the RIAA, while the US remains one of only three countries worldwide with a trade surplus in music.

“These numbers show a stable and sustainable foundation as music continues to be one of America’s strongest exports,” said RIAA VP of Research Matt Bass.

“Aligning our reporting to international standards allows us to tell that story more clearly than ever,” he added.