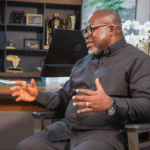

The Commissioner-General of the Ghana Revenue Authority (GRA), Anthony Kwasi Sarpong, says the law permits the Authority to use “reasonable force” against businesses and individuals who refuse to honour their tax obligations.

Speaking on Joy News’ PM Express Business Edition with host George Wiafe, he explained that the use of such measures is not arbitrary but strictly defined by law.

“Within that context, the law permits GRA to use some level of reasonable force when individuals are found to be making gains, and yet they are not,” he said.

He noted that taxpayers are first allowed to comply voluntarily.

“The law answers that if somebody owes taxes, you must give them 30 days’ notice. So we’ll give you the 30-day’ notice and write to you that you are supposed to do that.

“After the 30 days, if you don’t comply with it, the law gives opportunity to give you a notice that we may use extra force on the individual.”

Explaining how the law works in practice, the GRA boss said the Authority is empowered to step in where a taxpayer has the means but deliberately refuses to pay.

“In the area of domestic tax, the law empowers GRA that if you have money in your bank account and you are not paying your taxes, you can write to the Bank of Ghana and all the banks and say that the primary disbursement of your money must go to taxes.

“But this is used very rarely. It’s only in situations where the taxpayer has become recalcitrant, and yet we are fully aware that they have funds at the bank.”

He added that in some cases, GRA is permitted to physically restrict businesses.

“Sometimes the law also allows us to be able to physically block people from trading. So you may have a situation where you have a trader, and then GRA has come several times for you to pay their taxes, and they are not compliant.

“Sometimes the law allows us to do that. But let me say that these are, I call them reasonable force, because they are not the norm. It is only when it becomes very, very essential.”

Mr. Sarpong stressed that GRA’s approach has always been to balance firmness with fairness.

“As GRA today, over the last five years, we are invested in what we call Customer Experience resources, where we are engaging our people in the culture of dealing with taxpayers with respect, with cordiality, but at the same time enforcing the laws that ensure that taxes are paid.

“The posture that we’ve taken as leadership is using GRA to bring the human face in terms within the context of a customer experience.”

He further revealed that the law also allows flexibility when genuine difficulties arise.

“On rare occasions when you know that you are doing a good business but for one good reason or the other, you find yourself in financial difficulty, the law empowers us to be able to sit down with you and plan a six-to-one-year repayment plan.

“This facility, we avail it to many of our taxpayers, but it calls for discipline where the taxpayer will abide by the plan and make sure that this opportunity, given, they will not abuse it.”

According to him, this softer approach has yielded results.

“Before we deploy what I call the reasonable enforcement measures, we give these opportunities to taxpayers to take advantage.

“And I’m glad to say that many taxpayers take advantage of their recent plan and make sure that they comply with their taxes. And it’s worked perfectly for both GRA and their business.”